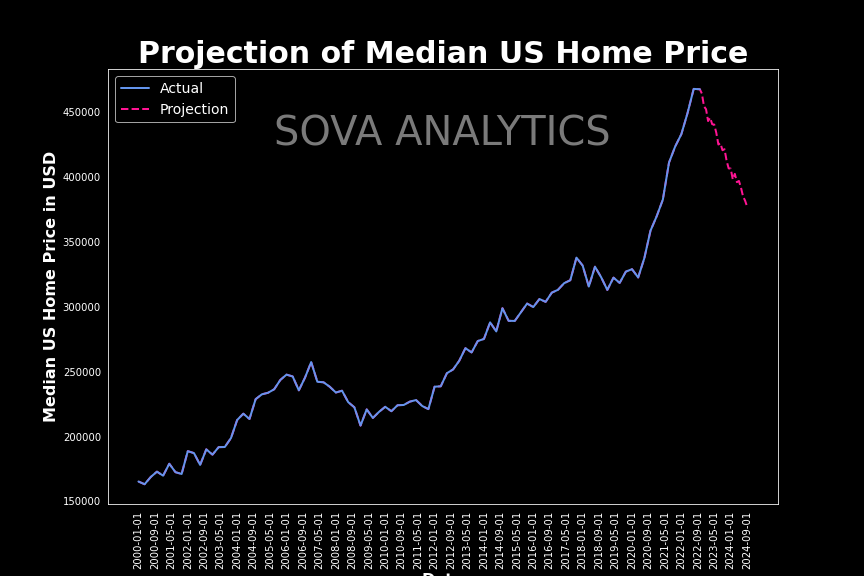

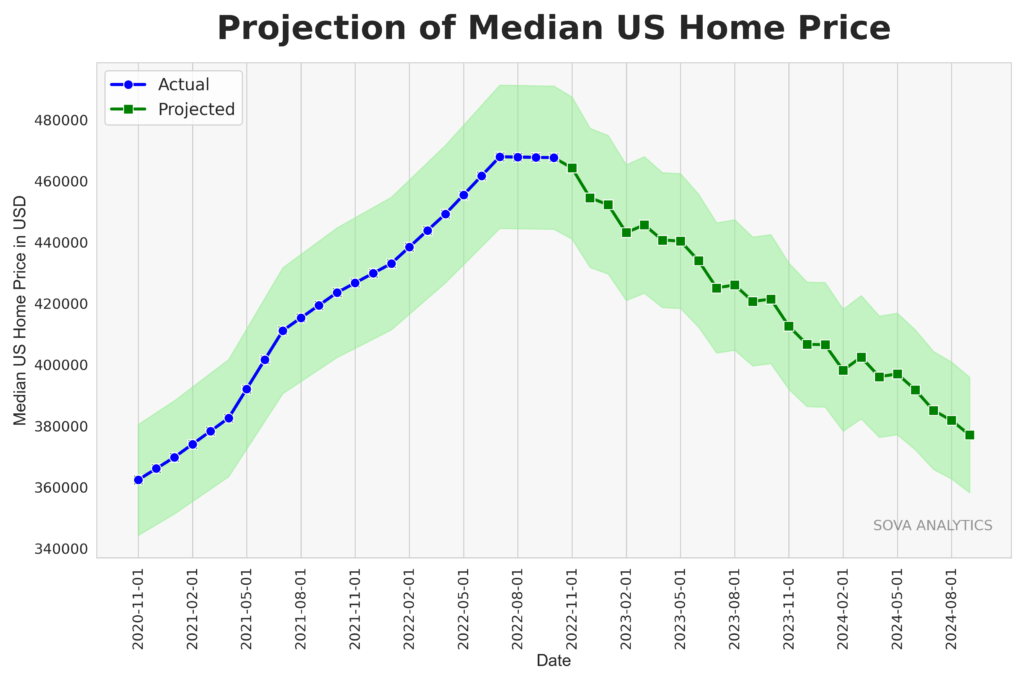

Welcome to Sova Analytics, where we provide projections of the US Median Sales home price. Our cutting-edge model employs a comprehensive approach, analyzing over 100 global macro indicators to project future changes in US median real estate values. We update our forecast on a monthly basis, carefully incorporating new data as it becomes available to refine our projections.

Our predictive model, in combination with other regional forecasts, can provide valuable insight into the real estate market. For instance, a homeowner may experience a decline in their local market value, but a strong national market could potentially reverse the trend. Conversely, a strong local market and a weak national market could signal that it’s a good time to consider selling, as national factors could contribute to future downward pressure on local prices. It’s important for homeowners to consider both local and national trends when making decisions about buying or selling property. Our model can help provide the necessary data to make informed decisions about real estate investments.

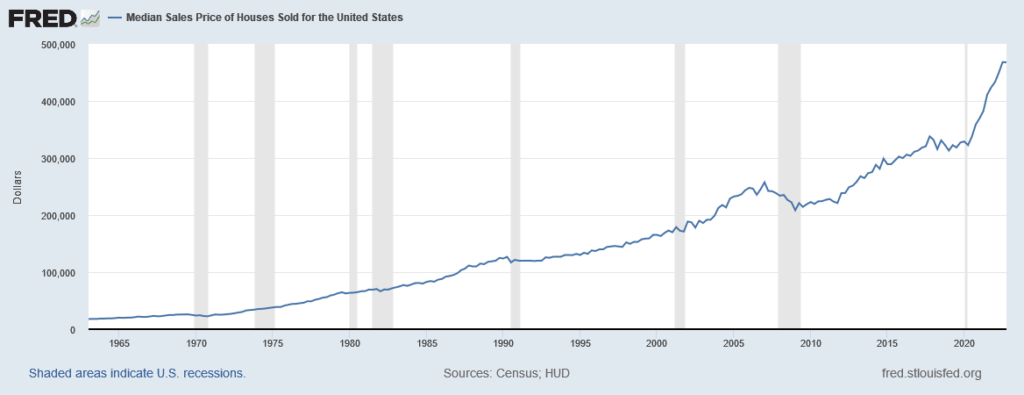

Median Sales Price of House Sold for the United States

The goal is to estimate the Quarterly US Median Sales home price provided by the U.S. Census Bureau and U.S. Department of Housing and Urban Development, which is a reliable indicator of the US housing market with historical data dating back to 1965 and encompassing 8 recessions. The methodology behind this indicator is detailed in the provided link. One of the reasons for choosing median sales price over the average is its ability to provide a more accurate representation of the housing market. .

For instance, consider the following scenario: six houses were sold, with five of them priced at $100,000 each, and the sixth house was sold for $1,000,000. If we calculate the average sales price, it would be $250,000, which is significantly higher than the most frequent transaction amount of $100,000. In contrast, if we calculate the median sales price, it would be $100,000, which accurately represents the most frequent transaction amount. Therefore, using the median sales price is crucial in avoiding skewed projections due to outliers in the housing market data.

Key Drivers

There are several factors that are likely to impact home values in the coming months. These include:

- Lower household incomes: As the COVID-19 pandemic continues to affect the job market, many households are facing reduced incomes, which may make it harder for them to afford homes.

- Higher interest rates: Interest rates have been historically low in recent years, but there are indications that they may begin to rise in the near future. Higher interest rates can make it more expensive to finance a home purchase, which can in turn lower home values.

- Inflation/building costs: Rising inflation and building costs can make it more expensive to build and maintain homes. This can put downward pressure on home values, as potential buyers may be deterred by the higher costs.

- US economy: The overall health of the US economy can also have an impact on home values. A strong economy can lead to increased demand for homes, while a weaker economy can lead to decreased demand and lower prices.

It’s worth noting that some of the key variables that drove up home values in 2020-2021 may now be working against home appreciation. As a result, we are likely to see retracement to pre-COVID values, especially if these key indicators continue to trend in a less favorable direction. Homeowners and buyers should keep these factors in mind when making decisions about real estate investments.

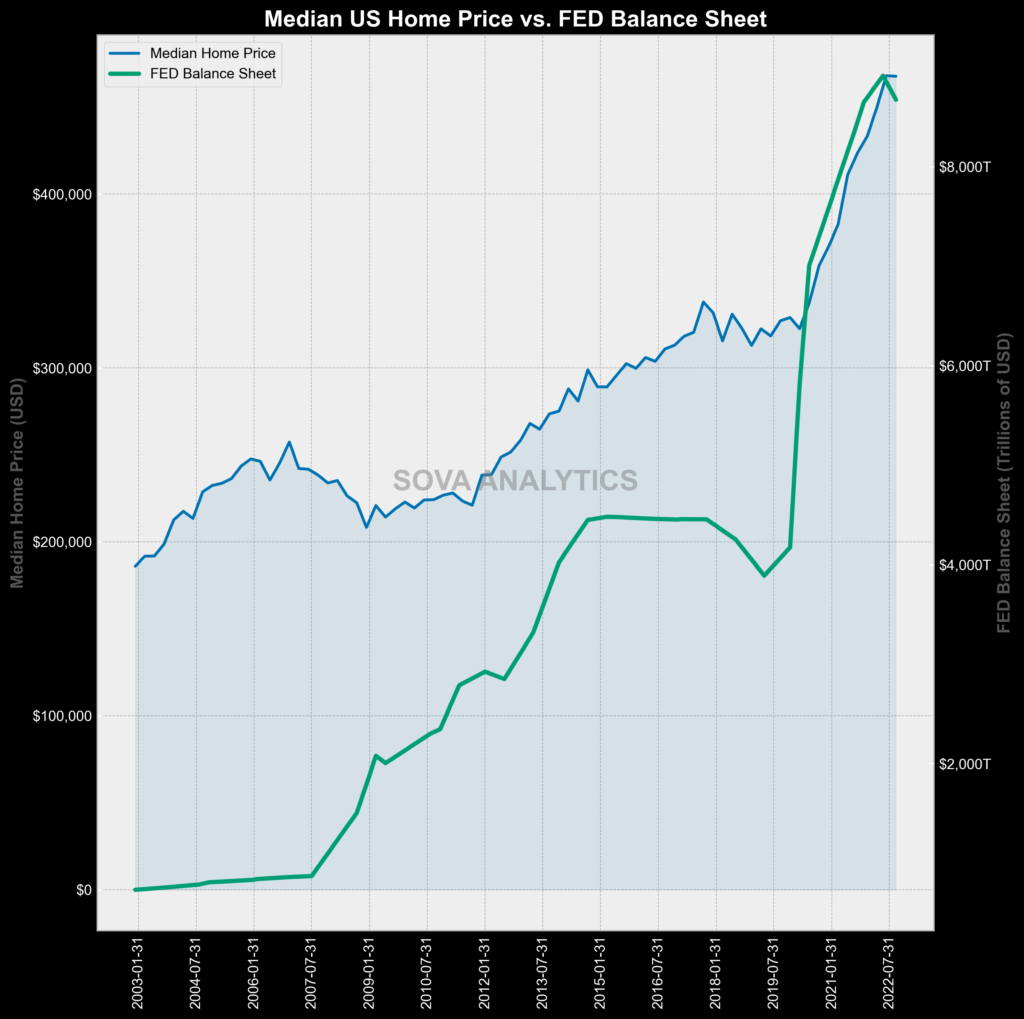

An Indicator’s growing influence

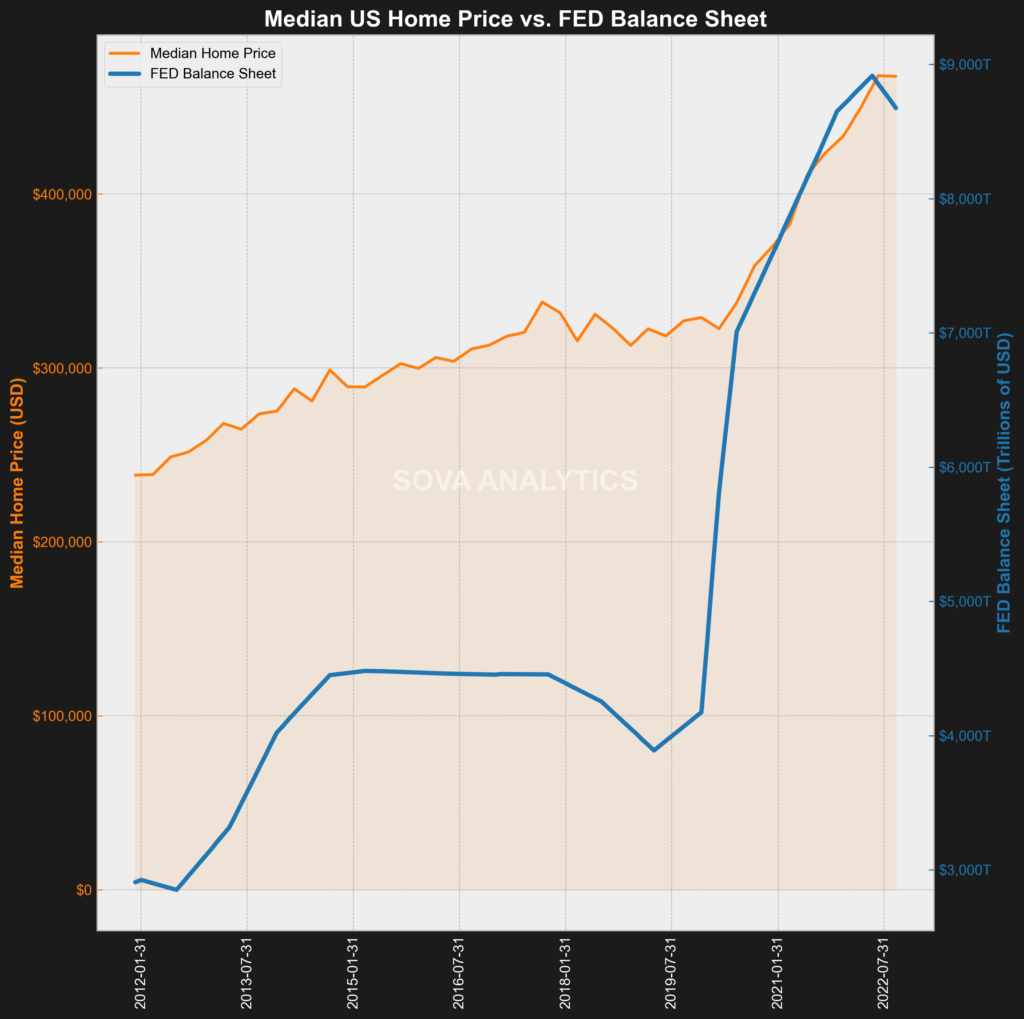

The balance sheets of central banks around the world have been steadily expanding since 2008, with a massive surge seen during the COVID-19 pandemic. As a data analytics company specializing in real estate, we closely monitor this trend as an important indicator of the market.

According to the Bank for International Settlements, the total assets on the balance sheets of major central banks worldwide increased from $10 trillion in 2008 to over $23 trillion by mid-2021. In the US, the Federal Reserve’s balance sheet alone has grown from $900 billion in 2008 to over $8 trillion in 2021.

It’s worth noting the correlation between the growth of the Federal Reserve’s balance sheet and real estate prices in the US. Since the onset of the pandemic, home prices have increased by almost 30%, according to the S&P CoreLogic Case-Shiller National Home Price Index.

Given these trends, we believe that the printing of money during the COVID-19 crisis has been a significant factor in the rise of home values. As of June 2022, the Federal Reserve has taken action to reduce the size of their balance sheet, and we will continue to monitor the impact of this policy on real estate values LINK. Stay tuned for the latest updates.

Future Updates

We will be providing monthly updates on these models, and we welcome your questions and feedback. If you would like to see additional metrics or have any suggestions, please feel free to leave a comment or contact us directly. We value your input and are always looking for ways to improve our analysis and reporting. Thank you for your interest in our work.