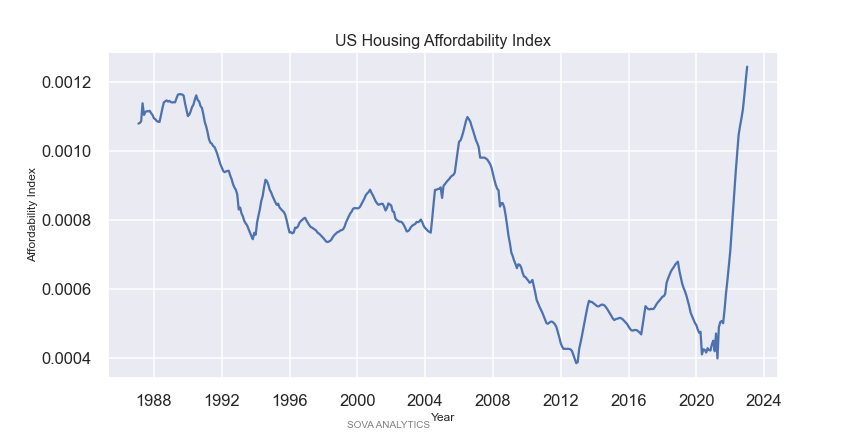

Welcome to the SOVA ANALYTICS Home Affordability Index. Our index covers the period from January 1987 to present, taking into account three critical variables: home prices, interest rates, and household incomes. The index measures the affordability of housing, with a higher reading indicating less affordable housing and a lower reading indicating more affordable housing.

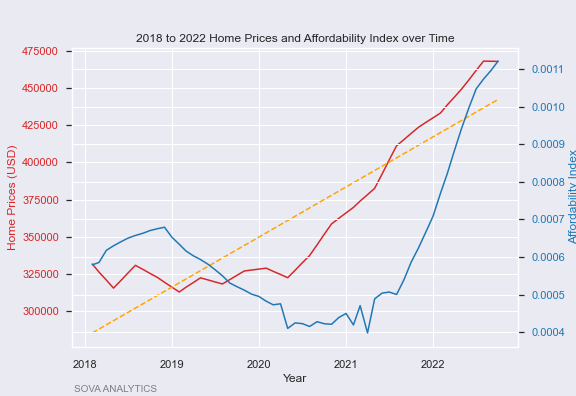

Our charts above illustrate that between 2012 and 2020, housing in the US was the most affordable it has been in almost 35 years. However, with the onset of the COVID-19 pandemic, home values began to rise, and interest rates increased, resulting in the highest reading in over 35 years. This unprecedented situation has never been observed in our dataset, indicating a significant shift in the housing market’s affordability.

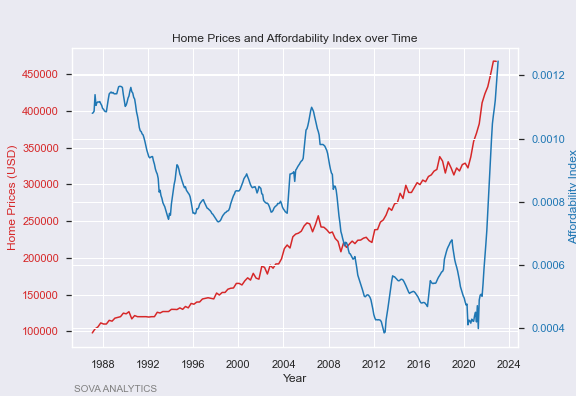

Home Affordability Index and Home values

In this analysis, we will examine three specific periods and assess the impact of each peak in the index on home values. By doing so, we aim to provide valuable insights into the relationship between the Home Affordability Index and home values.

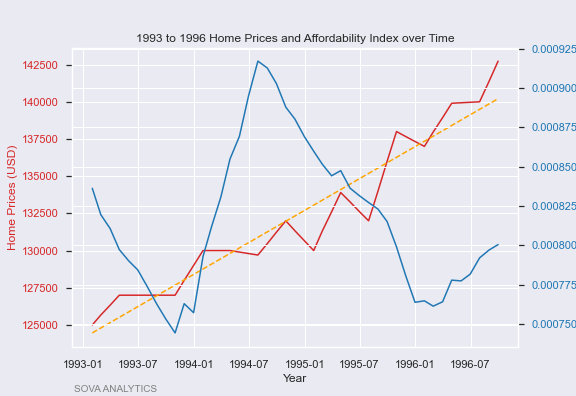

Home Affordability Index and Home values 1993-1996

Between 1993 and 1996, significant developments occurred in the housing market that provide valuable insights into the relationship between interest rates and home values. In 1993, the affordability index showed that housing was becoming more affordable. However, this trend was short-lived, as the affordability index spiked from January to July 1994, indicating that housing was at its most expensive during this period.

This sudden increase in the index can be attributed to the Federal Reserve’s decision to raise interest rates multiple times during this time frame. These rate hikes caused mortgage rates to increase, making it more expensive for home buyers to borrow money to purchase homes. As a result, the index increased sharply, indicating that housing had become much less affordable.

Interestingly, during this spike in the index, home values stalled and dropped below the slope line for the four-year time frame, indicating slow growth in home prices. However, towards the end of 1995, home prices crossed the slope line, indicating faster home price appreciation. This was the same time when the affordability index showed that homes became more affordable.

Notably, between 1994 and the beginning of 1995, the price of homes remained around the $130,000 range, except for a small dip that occurred during the slight reversal of the index.

The spike in housing prices during this period can be attributed to the fluctuations in interest rates, which increased and then decreased. The chart below reflects these changes and demonstrates how changes in interest rates can significantly impact the housing market’s affordability.

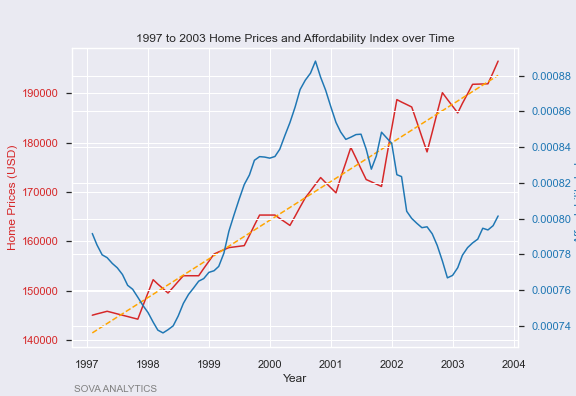

Home Affordability Index and Home values 1997-2003

Moving on, let’s examine the peak period of the affordability index from 1998 to 2003, which differs from the previous spike in 1993-1996. In this period, home prices continued to rise despite the affordability index indicating that housing was becoming less affordable.

Initially, interest rates were low in October 1998 but gradually increased until January 2000, which aligned with a higher reading in the affordability index, indicating more expensive homeownership. Despite this, home prices kept rising during this period.

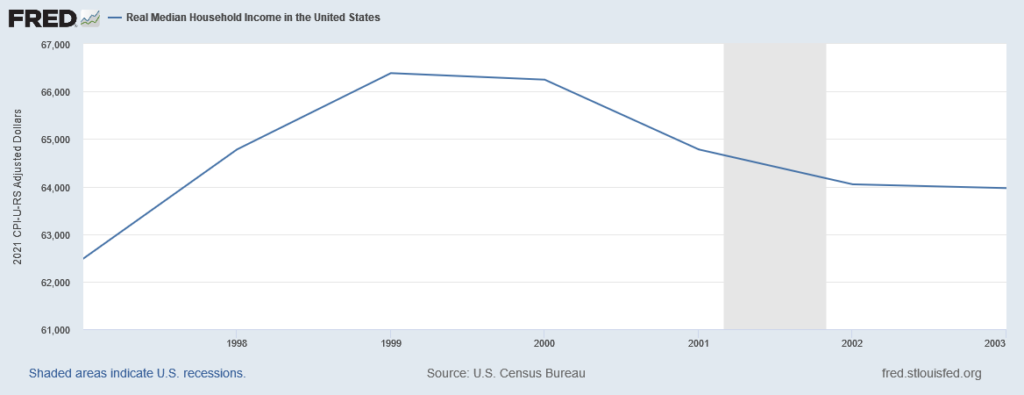

What led to this divergence? The chart below highlights that median household income experienced a significant surge from 1997, reaching its peak in 1999. However, the dot-com crash had a massive impact on incomes, which fell steeply. During this period, as interest rates were cut, the affordability index improved, but home prices held their value.

It’s crucial to recognize that the relationship between home prices, interest rates, and household incomes is complex and can significantly impact housing affordability.

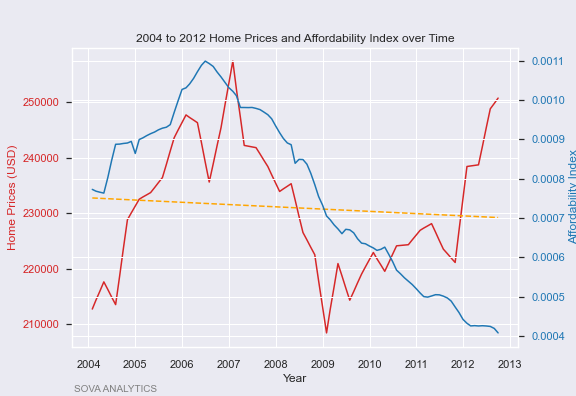

2008 Affordability Index and Home values

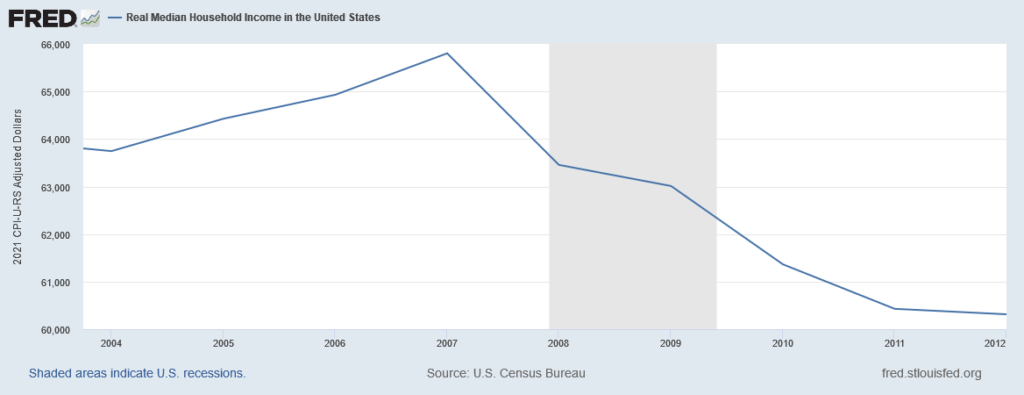

Let’s examine the period between 2004 and 2012, which includes the 2008 housing crisis, in more detail. Interest rates remained relatively stable from 2004 until the end of 2007 and then started to decline through 2012. During this period, household median incomes continued to increase until they peaked around the start of 2007, after which they began to decline and continued to do so through 2012.

Between 2004 and 2007, home prices rapidly increased, but then began to decline in 2007, hitting their lowest point in 2009. However, from 2009 to 2012, there was a recovery in prices. Despite the fluctuations in home prices, it’s interesting to note that the affordability of owning a home continued to improve from the peak house prices and continued to do so until the end of the time frame.

This improvement in affordability can be attributed to the decrease in interest rates, which made it cheaper for home buyers to borrow money to purchase homes. Additionally, the decline in household incomes also played a role in the improved affordability of owning a home, as it reduced the demand for homes and, consequently, home prices.

It’s important to note that the 2008 housing crisis had a significant impact on the housing market and the economy as a whole, and it serves as a reminder of the complex interplay between home prices, interest rates, and household incomes in determining housing affordability.

2023 Situation

The housing market has undergone significant changes in recent years. Interest rates decreased from 2018 until the end of 2020, but have been on the rise since then. Real median household income reached its peak in 2019, but has since been mostly flat or slightly declining through 2021. COVID-19 aid provided a temporary increase in disposal income, but it has now stopped, resulting in a decrease in disposal income. Meanwhile, home prices have risen considerably until the fall of 2022.

The current situation in the housing market is characterized by flat prices, rising interest rates, and declining household incomes, resulting in an all-time high affordability index. However, if incomes cannot support the high home prices as they did during the period from 1997 to 2004, there could be a stall in home appreciation due to higher interest rates, as seen in the period from 1993 to 1996.

Considering these factors, it is possible that home prices may experience a price correction in the near future. The affordability index being at an all-time high suggests that demand for homes may not be able to keep up with the rising prices. Furthermore, the increase in interest rates could further decrease the demand for homes, potentially leading to a decrease in home prices. However, predicting the future of the housing market is subject to various uncertainties, and many other factors could also come into play.

ONE FOR THE ROAD

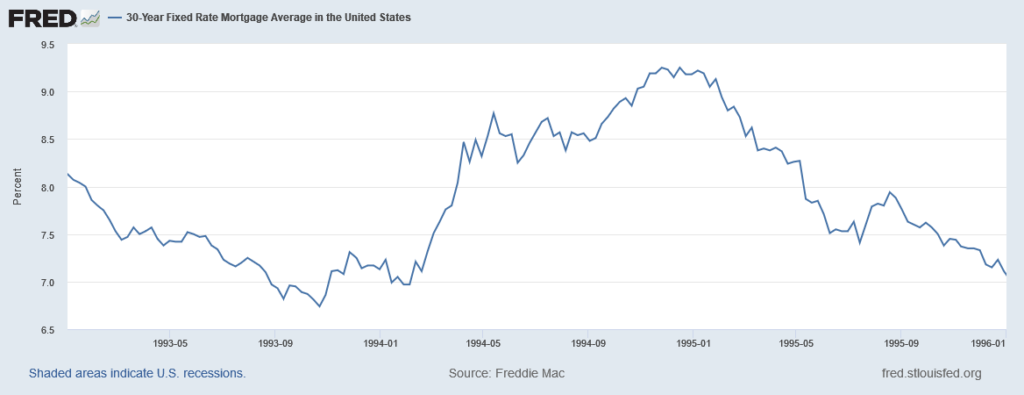

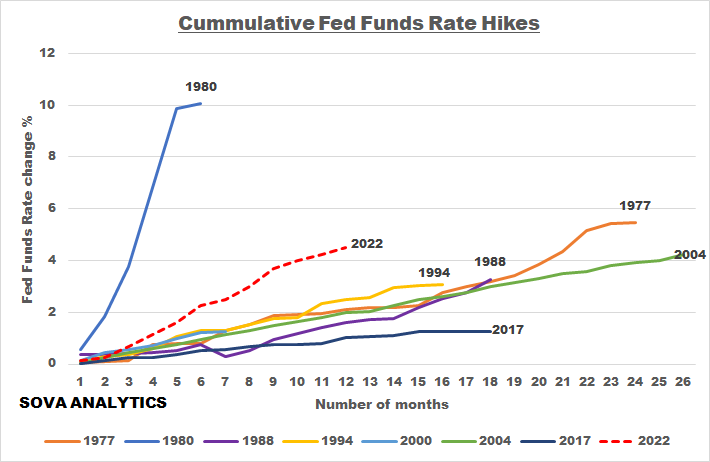

We previously discussed how increasing interest rates can impact home values using the example between 1993 and 1996. However, we didn’t provide the rate of increase of those rate hikes, which is an important factor to consider.

To provide a more complete picture, we’ve included a chart below that shows the velocity of Federal Reserve rate hikes over several time frames, including the most recent hike. It’s essential to note the current increase and assess whether potential buyers can handle such interest rate changes. As changes in interest rates can have significant effects on the broader economy, it’s crucial to stay informed and make well-informed decisions.

Source: Link

Additionally, SOVA Analytics can assist in analyzing and interpreting these trends in the housing market by utilizing advanced data analytics techniques. By analyzing data sets from various sources, SOVA Analytics can help identify trends and patterns in the housing market and provide insights into how changes in interest rates and other economic factors can impact the affordability of home ownership.

Overall, by utilizing SOVA Analytics’ data analytics expertise, individuals and organizations can gain a better understanding of the housing market’s complexities and make informed decisions based on data-driven insights.

DISCLOSURE STATEMENT

CITATIONS:

U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DSPIC96, March 10, 2023. Link

S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPINSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPINSA, March 11, 2023. Link

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, March 11, 2023. Link

U.S. Census Bureau, Real Median Household Income in the United States [MEHOINUSA672N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEHOINUSA672N, March 10, 2023. Link